There are several changes proposed by the government with the aim of combating the real estate crisis. Check out our guide on the new rental measures in Portugal.

1. Tax exemption until 2030 if you transfer real estate from local accommodation to traditional rentals

The government proposes that all Local Lodgings that transfer their property to the residential rental market before the end of 2024 will benefit from a full tax exemption (income from 2023 onwards will not be subject to IRS).

On the other hand, owners who keep their property as Local Housing will have to pay an extraordinary contribution, which the State will use to finance affordable housing policies.

By 2030, no more AL licenses will be granted and, in 2030, all existing licenses will be reviewed – and then re-evaluated every 5 years.

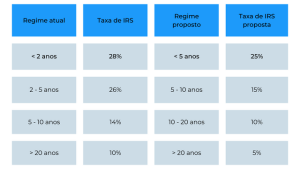

2. General IRS cut from 28% to 25% and reductions for long-term leases

The tax rate applied to rental income will be reduced from 28% to 25%.

The government also intends to grant advantages to lessors who opt for long-term leases, as described in the table below.

3. You can choose to rent directly from the State and the State will sublease your home

You can also choose to rent the house to the State, so that it can sublease it to private individuals. The State guarantees that the future tenant will only pay the State a rent that does not exceed 35% of its income, and the difference between this rent and the rent paid to you by the State (since the rent will be at market rate) will be paid by the State.

4. The State pays the rent if the tenant defaults

The government proposes to replace the tenant in case of non-payment of rent within 3 months (the deadline for terminating the contract). This means that the 3 months will be paid by the State to the landlord, and that the State will also be able to help the tenant to make the payment if there is a social reason.

5. State supports tenants with high stress rates

If you have tenants who devote more than 35% of their income to rent and are in one of the first six IRS brackets, they are eligible for extraordinary assistance.

The maximum limit of this aid is 200 euros and it only applies to contracts prior to 2023, depending on the rent limits of each municipality (the same as those of Porta65).

6. IMI exemption on old rents

Refers to tenants with rental contracts prior to the Régimen de Arrendamientos Urbanos (1990) and:

- whose corrected gross annual income is five times less than the annual minimum interprofessional wage; or.

- whose age is over 65 years old; or

- with an accredited degree of disability equal to or greater than 60%,

Landlords with this type of contract will be exempt from IMI, and their real estate income will be exempt from IRS.

7. Rent increase ceiling for 2023

Properties that have been on the rental market for more than 5 years may not increase their rents by more than 2% over the previous rent, excluding the automatic update of the previous three years.

In other words: imagine that you have already increased your rent in the last two years according to the update provided by law; in 2024, you will be able to increase your rent by 5.43% (2% plus the 3.43% you would have increased in 2023 if the government had not imposed the cap).

New rental measures – other measures

In addition to the new rental measures in Portugal:

- The leasing of vacant housing to the State, for subletting to private individuals.

- Simplification of the conversion of commercial and service properties into residential properties.

- The cessation of the granting of Gold visas.

- Changes in housing loans granted by banks.

- Changes in the taxation of capital gains associated with the sale of real estate.

- Exemption of capital gains on the sale of real estate to the State

- The mobilization of public land for affordable rental projects, the responsibility of designers (they now have a term of responsibility when approving projects)

- The application of penalties with interest on arrears to municipalities and organizations that fail to comply with the legally established deadlines for construction

- Funding for municipalities to carry out forced construction works through a line of financing valued at 150 million euros.

The “More Housing” program, presented on February 16, aims, according to António Costa, to respond in a “global and complete way in all the dimensions in which we have to act to respond to the housing problem”.

The dozens of measures unveiled, with repercussions on rent, local housing, taxes and state support for families, among others, will be subject to public consultation for a month, and then sent to Parliament. There are as yet no dates for their entry into force.

The rental market has changed – what are the opportunities?

With the new measures proposed by the State, there are many opportunities for the rental market in Portugal. The year 2023 will certainly be a time to invest in long-term rentals, and taking advantage of these changes could be very advantageous for you.

If you would like to see more long-term rental properties on Inlife, or if you have any questions about our guide to the new rental measures in Portugal, our team will be happy to help.